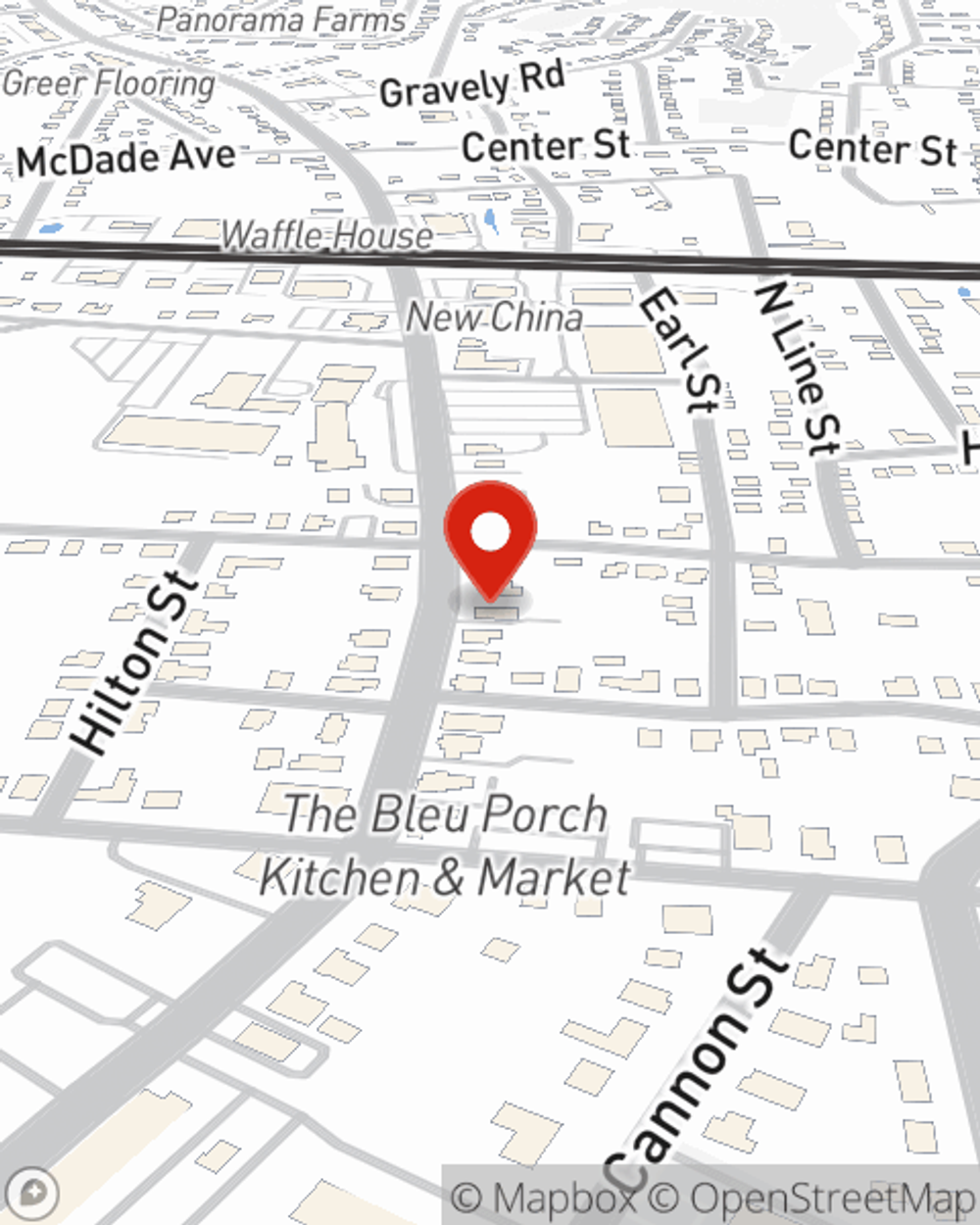

Business Insurance in and around Greer

Looking for small business insurance coverage?

Insure your business, intentionally

- Taylors

- Greenville

- Spartanburg

- Lyman

- Duncan

- Landrum

- Greenville County

- Spartanburg County

- Woodruff

- Travelers Rest

Insure The Business You've Built.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or loss. And you also want to care for any staff and customers who stumble and fall on your property.

Looking for small business insurance coverage?

Insure your business, intentionally

Keep Your Business Secure

With options like business continuity plans, errors and omissions liability, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent John Jeter is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Eager to research the specific options that may be right for you and your small business? Simply call or email State Farm agent John Jeter today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

John Jeter

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.